My business is real estate, the ownership and management of apartments. At the highest conceptual level, the business is about creating value in the hearts and minds of all stakeholders (roughly in proportion to their stake) and then harvesting that value. Our three largest stakeholders are our Customers, our Team Members, and our Investors/Owners/Banks followed by our Vendors and the Community at large (I’m a big believer in the Social Contract and Main Street Values).

In the practical sense, creating value generally means fostering sustainable NOI (Net Operating Income: Revenue – Expenses). In the real world, a million variables go into that equation. Sometimes we chase occupancy, sometimes rent growth is the best path, other times expense control. Confusing to some, at times the best course of action is the seeming opposite of expense control: invest more, re-position or improve the asset, a viable choice when the customer values the improvements and is willing and able to pay sufficiently more to entice investment dollars. Our communities range across the spectrum, each with its own unique complexities: student housing, affordable, luxury, market rate. In addition, we operate in multiple markets, each with its own nuances.

While at the 50,000 foot level the rules stay the same: “Create Value Ethically, then Harvest”; at the ground level how to implement that changes as fast as circumstances change.

When occupancy is low, fill up your community as fast as possible, probably staying on the lower end of the rent range in order to do so (did I mention that Residents need to have sufficient credit/employment to afford the rent? I’ve forgotten to mention that in the past, assuming it was obvious, and have had to end up evicting massive numbers just a few months later when an “empowered” manager “met” occupancy targets by deploying across the board their limited authority to waive credit history in special cases.)

However, once you’ve reached low to mid-nineties, greatest revenue growth usually comes from finding the maximum rents your community can command i.e. it is time to start raising rents. So when occupancy rises, I start asking the question: What is the maximum rent you can get? Are you maximizing rents?

I can’t tell you the number of times I’ve gotten push back: “But you told me to maximize OCCUPANCY, not rents”.

I reply, “Remember the overall goal? Max NOI? What I said was that the best way to max NOI is to max occupancy while you are in the 80’s, then when you get to the low to mid 90’s in occupancy, start thinking about maxing rents.”

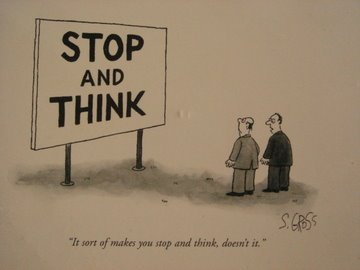

The truth is, it is impossible for every conversation to be a “complete” conversation i.e. you cannot footnote every statement, there needs to be a mutual understanding of the overall context/goals.

As always, I share what I most want/need to learn. – Nathan S. Collier