There really is very little difference between people but, over time, that little difference makes a big difference.

There really is very little difference between people but, over time, that little difference makes a big difference.

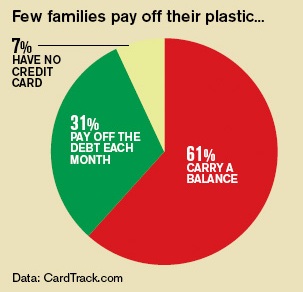

Business Week (2/18/08, page 36) states that 61% of Americans carry a balance on their credit cards (one of the most expensive forms of credit short of your neighborhood loan shark). Only 31% pay off their balances monthly (the remaining percentage do not have credit cards).

Embracing the habit of thrift is a basic and empowering financial skill. From the moment I understood the concept of money, I never understood why people would spend money differently the day after payday than the day before. My mother was not the world’s greatest money manager and we had our power turned off more times than I can remember, and even got evicted a time or two.

For me, even a wet-behind-the-ears kid, it was simple math. X dollars, Y days, Z dollars per day to spend. Budgeting did not require rocket science. So simple a child could do it. Rent is this much, utilities should be this much, groceries that much, car payment, gas, etc., etc. These were all known or at least estimable. What was left over went into savings, after savings was at a safe level, you think about some pocket money, some Friday-night money.

If you kept running out of money, then you needed to either find a way to make another honest dollar or you needed to change your lifestyle.

In college, undergraduate school and graduate school, I worked two jobs. Why? Simple: One job didn’t pay the bills. I pumped gas during the summers, slung hamburgers at night. Worked as a nurse’s aide at the student infirmary for 5 years (2 years undergrad, 3 years grad, if memory serves). Also worked property management and did maintenance on rentals. I carried a trunk full of tools and supplies (faucet washers, toilet wax rings, door knobs, light switches and cover plates, window cranks, even a toilet seat) and could knock out a lot of minor service issues on the spot.

When I graduated and got my first professional job, I decided the student lifestyle suited me just fine and I did not upgrade (other than a some new suits). Drove the same old, beat-up car, lived in affordable neighborhoods, poured money into my savings account. I had a plan to invest in real estate and I desperately needed some seed capital.

Saving was not sacrificing: I had a plan, a goal. It was fun. Every dollar I saved took me closer to that goal. I made a game out of how many free things I could find to do on the weekends. I took a great sense of pride and accomplishment in seeing how far I could stretch a dollar.

I was well into double-digit millionaire status before I bought my first new car. Used cars always seemed like such a better value. And, okay, in the beginning I had to become a pretty good shade-tree mechanic to keep the used cars running. In my day I did valve jobs, brake jobs, ring jobs. As I got older, I tended to buy low-mileage, one- to two-year-old cream puffs.

Think of how deeply that thrift ethic ran: I was past 40, literally owned thousands of apartments, and I was still buying used cars. I have ALWAYS lived below my income, no matter what it took. When I was young, it was save 20%, live on 80%. Now it is closer to live on 20%, re-invest 80% in the business.

I saw an ad the other day selling luxury watches on time payments. I was horrified. I still find it shocking that someone would incur debt for a personal good. A house, sure. A car, okay (but don’t buy more car than you need). But for clothing? For a vacation? For a wedding? Never!

And I have never, ever run a balance on a credit card.

At first, your habits impact your life. But over time, they create and direct your life. There really is very little difference between people but, over time, that little difference makes a big, big difference.