Debt: Friend or Foe? In some respects this is a silly question. I might as well ask “Food: Friend or Foe?” In moderation, consumed intelligently, both are excellent servants. Used to excess, both are lousy masters. Bankruptcy and obesity are the almost inevitable results of gluttonous guzzling.

Debt: Friend or Foe? In some respects this is a silly question. I might as well ask “Food: Friend or Foe?” In moderation, consumed intelligently, both are excellent servants. Used to excess, both are lousy masters. Bankruptcy and obesity are the almost inevitable results of gluttonous guzzling.

I am a real estate investor and operator; I provide apartments. My economic success is in many ways tied to the intelligent use of debt, the wise use of leverage.

Initially, many of my purchases were owner financed by sellers who trusted me and my reputation for timely payment that I had arduously built up. One fine day, a banker, literally out of the blue, walked into my office on a cold call and said those magic words every struggling small business person loves to hear: “Do you need any money?” The cold call, however, was no accident. It was a foreseeable result, the fruit of hard work. The unspoken words were, “We at Barnett Bank, a local, community-focused bank, have heard of your economic success, your business acumen, and good payment record and think you would make a good long-term customer; we are coming to you before you go to our competition.”

Well, I did need money and for many years thereafter Barnett was my bank. They were great to work with. We forged a working partnership that served us both well. Over the years, I worked my way up the lending ladder, eventually graduating to working directly with the capital markets groups of national banks as well as getting loans directly from major insurance companies and pension funds, as the size of my financing requirements allowed me more direct access to capital providers (capital providers is just a fancy phrase for lenders when you borrow lots and lots of money).

The point I wish to make is that throughout all this, I

1) Never, ever borrowed money for personal reasons other than for a car or a residence.

2) Never, ever ran a credit card balance.

3) Always lived beneath my income, making a game out of being thrifty.

4) Always had savings/investments; I paid myself first.

I was well into my forties, maybe 45, before I stopped buying used cars for my personal vehicle; the first year depreciation was so horrendous that it always seemed such a poor investment! Understand: At a time when I already owned thousands of apartments (all bought very carefully), I was so fiscally conservative that I would not buy a new car. I certainly could afford to. It just seemed such a waste of money. Still is, but now I do it. However, I tend to drive the less flashy models. I have a diesel, a Prius, and a Smart Car. I have never owned an 8-cylinder car. They seem sooooo wasteful and I’ve felt that way for decades, long before green became fashionable.

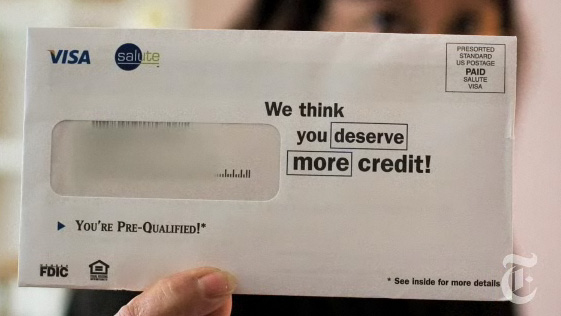

I never ran up debt to maintain a lifestyle. Recently, I saw a huge ad on the side of a building in Manhattan offering financing to buy a luxury watch. Debt for a watch? Look on your cell phone or ask the person next to you for the time. Better yet, chill out.

I never understood the urge to consume to get your sense of identity or to boost your self image.

To me, my self image was boosted knowing that I was not an indentured servant to a credit card company. I got a lift in my step, not from the expensive threads on my shoulders, but from knowing that I had a few months worth of expenses stashed away in the bank. That made me my own man, beholden to few or none.

When I borrowed money it was to make an investment, to buy real estate that I was certain would make a higher return than the cash I borrowed, where the income would more than cover the payments. And since I am a conservative investor from the word go, a realistic optimist, when I say “certain to make a higher return” you can bet that I’d thought this through seven ways from Sunday, assiduously educated myself on the issue and, just to be safe, included a good margin for error. Plus I had stored up some nuts for the winter, just in case. When I move a piece out into the center of the chess board, I like to have it covered twice AND have a line of retreat. I might win faster if I gambled more, took more risk, but you know what? My way, I don’t lose often. Slower games, surer wins!

I did not spring out of the womb full of financial savvy. Three things stand out in my early years:

1. I was blessed with a father who made family finances an open book. We knew how much it took to run the house and we knew pretty closely how much we had to do it with. I say we, because my father treated us like mature individuals capable of contributing to the smooth running of domestic operations. Of course, as a single parent with three kids, he may not have had much choice! His economic tutelage continued all my life as we had many spirited talks on the direction of the economy and the right approach to stock market investments. (I’m an index kind of guy. He always thought wise choices could beat the market.)

2. I made the wise choice to take a junior high school course that included a section on budgeting and balancing a check book. I do not remember the title but it had something to do with household finances, and the fact that more girls than guys took it might have had something to do with my signing up for it. Ever since, I’ve thought that economic basics where as important as the 3 Rs.

3. Believe it or not, I also honestly think that all those games of Monopoly I used to pester my sitters into playing with me also had a hand in the growth of my sense of the value of money and the wise consumption thereof.

Like many things, whether debt is a friend or foe depends a lot on you. Surprise.

This blog was inspired by the following New York Times article:

0 Comments