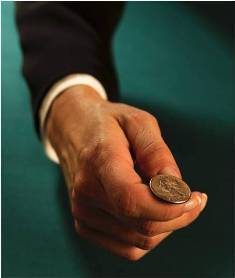

Take a hundred newly-minted Harvard MBAs. Set them to work flipping coins. Track who flips nothing but heads. When you are down to one person, pick him or her to run your hedge fund, invest your money, or be your CEO.

Take a hundred newly-minted Harvard MBAs. Set them to work flipping coins. Track who flips nothing but heads. When you are down to one person, pick him or her to run your hedge fund, invest your money, or be your CEO.

Stupid, right?

But we do it ALL the time!

“Luck vs. Skill” is the title of a new study from University of Chicago’s Booth School of Business. “’People do not understand the effects of chance (on returns)…and it is impossible to tell how big an element chance is (in good performance),’ says Eugene Fama, professor of finance at the University of Chicago. ‘Fund managers do not have enough skill to produce risk adjusted expected returns that cover their costs.’” (The Wall Street Journal, December 3, 2009, “Top Mutual Funds: Just Luck or Skill?”.) Or as WSJ summarizes: “…many studies have shown that the vast majority of active funds can’t beat the S&P 500….” This is particularly true after adjusting for fees and higher trading and transaction costs of actively-managed funds.

Yet hope springs eternal in the human heart and people keep hoping that this fund manager or that one will be able to consistently beat the market. Instead, they just end up paying unnecessarily fees and trading costs, in effect lining someone else’s pockets with what should stay in their retirement funds.

Humans love to see patterns where there are none, subscribe causation to events that are really random. “Drunkards Walk” is an excellent book on the subject, truly an eye-opener.

Correlation is not causation. Proximity is not causation. Non sequiturs abound. Healthy skepticism, a strong dose of independent thinking, and a willingness to question and demand coherent, verifiable proof: these traits will serve you well in life.

0 Comments