“It is what we think we know that keeps us from learning.”

“It is what we think we know that keeps us from learning.”

— Chester Barnard

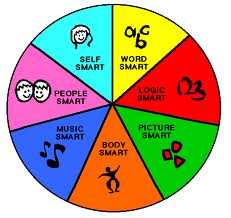

Everyone has a learning style or a preferred way of learning, a way by which we best process information. Some prefer to hear new information, others prefer to see it graphically, others may prefer to read it. Some people like their information all at once, while others prefer to process it in smaller bits, to have time to warm up to it. Some are morning people, others come alive at night. Some like to discuss things in a group, handling the information verbally, tossing it around, seeing how others see it or react to it. Others prefer to mull it over in their own minds first, come to their own conclusions before they interact.

None of these styles are good or bad, they just are. What’s “bad” is not being aware of your style so that you’re not able to learn as effectively or efficiently as possible. Also, it is possible to have different primary learning preferences for different types of information, e.g., math formulas versus an operations manual may call forth different learning preferences.

Certain types of information I prefer to see, since I can read faster than most people can talk. And when I read, I can choose which portions of the information I wish to skim and what I wish to review in depth.

Other types of information (generally softer) I prefer to hear, and some presentations I want to hear in person so I can read the presenter’s body language and ask questions. By softer types of information I mean where the human element plays a greater role than hard math or analytics.

When I’m choosing among banks to place a certificate of deposit, it is primarily hard information: rate of return, length of time. Same with the calculation of a promote at the end of a real estate deal: the math is the math (absent any interpolation issues).

Even when you think you are dealing with hard information there can be a strong “soft” information component. The decision to make a real estate investment may seem relatively cut and dried but it is dependent on projections, and the level of confidence and enthusiasm that my operations team has around those projections is information best determined in person. And often to properly evaluate soft information, it is important that I have a base line of experience with the person.

I know people who are enthusiastic about everything and anything, never met a deal they did not like. I know others who would not buy Manhattan for the legendary $24 dollars worth of beads. Knowing someone’s personality base line lets me make a more nuanced evaluation of the information I’m receiving.

This is a classic from the NSCBlog archive, originally posted September 12, 2007.

0 Comments