Hello Mr. Collier,

I hope all is well with you.

When you have some time, could you please answer the following question?

Thank you so much for your time, consideration and wisdom.

How would you describe permanent financing rate?

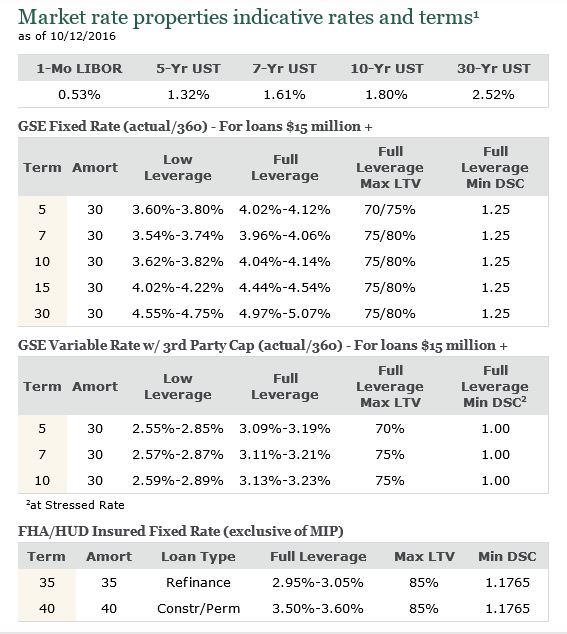

Not sure I know what you mean by permanent financing rate? We generally finance our real estate for a ten year term, 30 year amortization, 75% Loan to Value (LTV) at a spread over the 10 year Treasury Bill; the spread is currently in 195 to 215 bps range. Construction loans used to be as high as 80% Loan to COST and 225 to 275 bps over LIBOR. Feds are cracking down on the banks, forcing them to reign in all borrowers/developers, good and bad. Loan to Cost ratios these days more like 65% (300 bps spread) to 75% (350 to 400 bps spread if will do it at all). Loans are more costly at the higher leverages because banks must set aside more capital to offset.

We do occasionally do bridge loans (short term recourse bank loans, usually for one year, often non amortizing because of short term, if rolled over, may require a principal pay down but then may not), they generally require a personal guarantee from someone or some entity with a hefty balance sheet, LTV can range all over the place, ditto the spread depending on collateral, credit worthiness of the borrower and the banking relationship. I currently have a loan that I got to pay off a loan on a small apartment community, technically speaking it not a real estate loan but a line of credit to me personally with some real estate taken as additional collateral, this characterization gave the bank greater flexibility, they also put a floor on the rate which has kept it about a 100 bps above where it would be otherwise. Still cheap money though.

Below is a Rate Sheet from Wells Fargo as of 10/12/16.

As always, I share what I most want/need to learn. – Nathan S. Collier

0 Comments